The United States is ready to lift sanctions on Iran

EU Economic Advisor: Most of Iran's deposits are in Russia, which came to Tehran during the time of Mr. Bahmani, Deputy Governor of the Russian Central Bank, and Iran transferred more than $ 31 billion of its deposits to Russia and received rubles in return, a strange move This alone reduced the value of deposits by 40%.

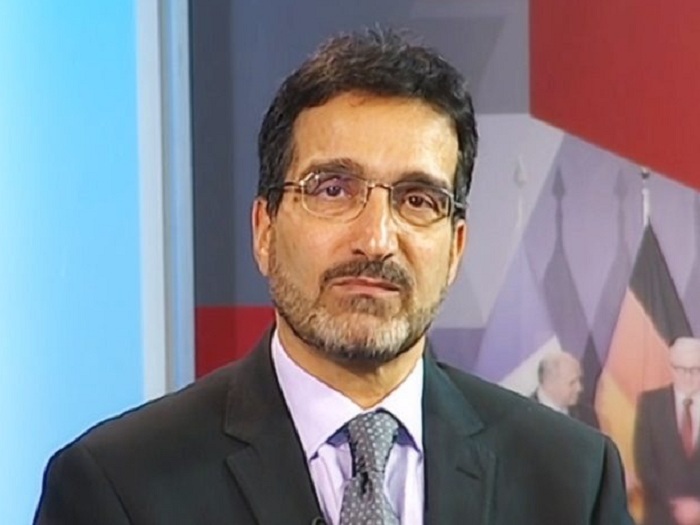

According to the International Iranian Stone Exhibition, Mehrdad Emadi said about the process of negotiations between Iran and Western countries and its economic impact: "Based on the conversations we had with the members of the two teams in Vienna, there is good and positive progress. 6 issues discussed have been agreed.

He continued: "Currently, the main gap is over the fact that Iran wants these talks to be in a package, but on the other hand, there is talk of a return to 2016 so that Iran returns to its commitments on enrichment and sanctions are lifted." Also, some of the sanctions imposed under Mr. Trump because they were proposed by Congress will be legally difficult to lift by presidential decree.

He also said that in the case of banking sanctions, the US Treasury Department has completed the preparations for the end of the sanctions. Of course, this does not mean the return of Iran's banking system to the global system, because both Swift and Europe 3 emphasize that until Iran joins the FATF, it can not use banking services without restrictions. As a result, there is a gap in this issue, but the space and speed of progress indicate the desire of both sides to reach an agreement.

The economist clarified: The Iranian team should focus on lifting sanctions on the three sectors of energy, Iran's banking system and transportation. Of course, Iran has added priorities that are more related to lifting the sanctions of the security institutions in order to get out of the sanctions in a one-step dialogue, and in my opinion, this is the most important brake of the agreement.

He said: "Perhaps the best step is for Iran to focus on the above three sections in order to expand the talks in the second dialogue or the supplementary dialogue, and to lift the main sanctions; In this case, the lifting of sanctions can have a positive impact on the economic life of the people.

In response to a question about the impact of lifting sanctions on Iran's economy, Emadi said: "If the lifting of sanctions is accompanied by the economy moving towards competitiveness, to the octopus monster and that monopolistic system that has fallen on Iran's economy and Iran's trade and energy sector." If it faces problems with non-tender contracts in the years before the embargo and before that, then it will have a significant shock to the Iranian economy.

He continued: "Perhaps the impact of these events in the next 15 months on people's lives in reducing inflation and in the next two years on reducing unemployment can be seen."

Emadi said: "If only the money is to be released and Iran can sell oil, but these monopolies will continue, then it will increase the import of consumer goods because this money is spent on strange purchases and brokers instead of investing in the industrial sector." This way they benefit. In this regard, lifting the embargo may compensate for the shortage of goods, but it is not a basic action.

"At the moment, we do not know the exact amount of Iran's blocked money, but according to a case in 2019, Iran had deposits of more than half a billion dollars in 21 countries," said an economic adviser to the European Union on the possibility of releasing Iranian assets.

He claimed: "Most of Iran's deposits are in Russia, which came to Tehran during the time of Mr. Bahmani, the Deputy Governor of the Russian Central Bank, and Iran transferred more than $ 31 billion of its deposits to Russia and received rubles in return, which was a strange move and only This reduced the value of deposits by 40%.

He continued: The Central Bank transferred dollar deposits outside Iran from the Central Bank of Moscow to this bank following the visit of Heath Ross. In the text of the agreement, which is in Russian, the Iranian official of the agreement agreed that by using this deposit, Iran would increase its trade and banking relations with the Russian side. In this framework, the price of payments and deposits in Russian private banks will be made at the official dollar-ruble exchange rate of the Central Bank of Russia, and the Iranian side will make every effort to pay a fee from the foreign exchange credit channel against this deposit. Use Russian companies and enterprises.

Emadi said: "In China, we have more than 30 billion dollars in various accounts, the use of which depends on the purchase of Chinese goods, which is not the right option for Iran."

He added that there are also blocked currencies in the UAE, Turkey, South Korea, Cyprus, Greece, India, Malta, Malaysia and Singapore. Also in the last five years, Iran has started opening accounts in Macau and Hong Kong. Therefore, according to the available information, Iran has more than $ 88 billion in blocked money, which naturally, if it is possible to use, it is possible that all this is spent on injecting modern technology from Korea, Sweden and Japan in order to update industry, economic security and growth. Be stable.

Emadi noted: "It will not be easy to get the money back from Russia and China, which was accepted during Mr. Ahmadinejad's time, but it is not impossible." Iran should have a legal team familiar with the economy, because most of them know the economic brokerage system, not the legal basis.