New details of changes in Czech rules

The Deputy Director of Payment Systems of the Central Bank stated: When people go to the branch to receive a check in case of deficit of the check amount in the current account of the issuer, they should ask the bank to check his other individual accounts in the same bank and if there are in those accounts, Pick up the check deficit amount and pass the check.

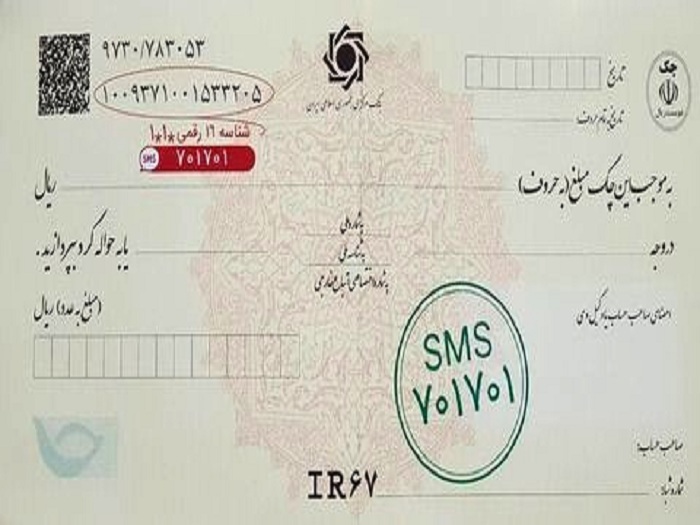

According to the International Iranian Stone Exhibition, Ameneh Nadalizadeh, referring to the regulations related to new checks, which will be issued voluntarily to applicants from the 20th of December and will be public from the beginning of next year, said: Transfer of checks with new appearance and contents Which will be distributed from next year and if the transfer levels are registered in the fishing system, it will be possible, but now the transfer of checks is as usual and there is no need to register in the fishing system.

He said that current and existing checks can also be issued on the bearer's money, adding that although current checks can be issued on the bearer's money, but the recipient of checks with new appearance and contents must be specified and registered in the fisherman's system.

Emphasizing that exporters and recipients of checks can now voluntarily perform the process of registering, verifying and transferring checks in the Sayad system, the Deputy Head of the Payment Systems Department of Markazid Bank added: A list of them is published in "Shaparak" and is available. Other programs and new portals of banks and credit institutions (Internet Banking and Mobile Banking) will be added to this list.

He continued: "Due to the optionality of this action, all checks will be accepted and processed as in the previous procedure without the need to register in this system in the country's banking network."

Nadalizadeh emphasized: When people go to the branch to receive a check in case of a check deficit in the current account of the issuer, they should ask the bank to check his other individual accounts in the same bank and if there is in those accounts, the amount of the check deficit Pick up and pass the check.

The Deputy Head of Payment Systems of the Central Bank said: "In addition to the possibility of registering, confirming and transferring checks in the Sayad system, which is currently optionally available to bank customers through mobile payment applications, in these programs, the possibility of" inquiring about the status " "Fishing check" is also provided for the issuer of the check and its beneficiary.

He added: "It is possible that the issuer, before the approval of the beneficiary and the beneficiary until before the approval or rejection of the initial registered check, is able to view the status and contents of the initial registered check in the fishing system using the fishing ID of the said check." will be.

Nadalizadeh emphasized: the implementation of the new check law and after it is mandatory to register the check in the fishing system, the holders of the returned check that has not been revoked cannot register a new check in the fishing system. It is also possible to transfer current checks through endorsement, but the transfer of new checks that will be delivered to bank customers next year must be done by registering the transfer in the Sayad system.

The Deputy Director of Payment Systems of the Central Bank pointed out: To register, confirm or transfer checks in the Sayad system through mobile applications, people must use a mobile phone whose SIM card is registered in their own name.

He continued: "Check issuers should be careful when using mobile applications to access the fishing system. In the authentication section, they must enter the details of the bank card that issued their checkbook, but to confirm or transfer the check, it does not need to be consistent." Bank card details are not checked with the issuing bank.

According to ILNA, people can refer to https://www.cbi.ir/EstelamSayad/19689.aspx to inquire about the credit status of fishing checks.

* ILNA