Preventing the issuance of bad checks is the main goal of the new law

Director of the Central Bank Banking Information Department: The new check law has been prepared with the aim of returning credit to the check, and the significant reduction in the number of returned checks shows that we are moving in the right direction.

According to the International Iran Stone Exhibition, "Mahboub Sadeghi" referring to the progress and challenges of the implementation of the new check law and the new services of the banking system, added: The parliament was convened and notified to the central bank for implementation.

He said that the new law has solved one of the current problems of the check, namely the impossibility of identifying and validating the issuer, adding: "The validation of the check is done systemically and in general most of the new features of the check are software and system to compatriots Will be presented.

Sadeghi stated: For example, a person who wants to use a check for his transaction, can not issue more than the amount of credit set for him by the check authentication systems.

"In the past, people needed to know the issuer of the check in order to be able to trust the issued check, but according to the new law, this identification will be done by the central bank and the banking system through accreditation," he said.

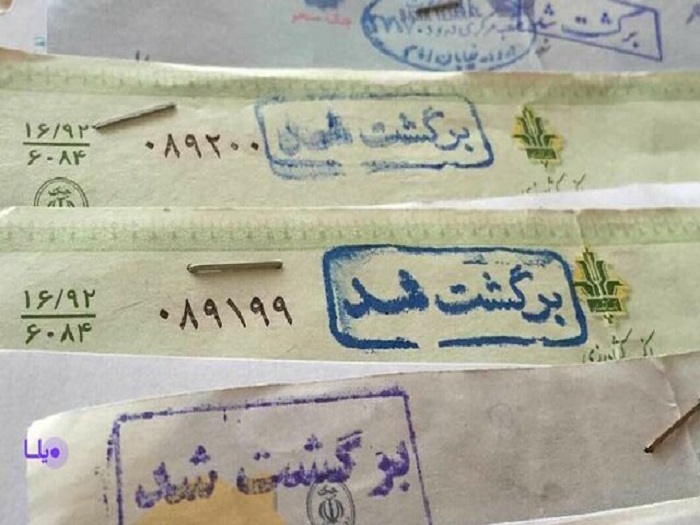

He added: "According to the repeated Article 5 of the new check law, bad accounts and issuers of unsecured checks will be subject to restrictions such as the impossibility of receiving a check, the impossibility of opening a new bank account, the impossibility of receiving bank facilities, impossibility of issuing bank guarantees and letters of credit."

The director of the Central Bank's Banking Information Department, noting that after the full implementation of the new law and the return of the check credit, we will see an increase in the use of checks in transactions, said: Regarding carrier checks, checks are assigned in the systems provided for this purpose. It is recorded to determine the process of check circulation and to reduce abuses and money laundering in this way.

Emphasizing that the process of eliminating the effect of a returned check will not change much, he added: "To eliminate the effect of a returned check, the person must either pay the amount of the check or have a letter from the judiciary stating that his returned check was stolen or misused." Or, by going to the notary public and presenting the official consent of the plaintiff, to eliminate the misuse of the check.

Sadeghi said: "The new check law is a very progressive law that has been prepared with the cooperation of various institutions and devices and tireless efforts. It will be implemented step by step from the end of December this year."

According to IRNA, the "Law on Amending the Law on Issuance of Checks" was amended and revised by members of the Islamic Consultative Assembly on November 4, 2016. Now, after approximately two years from the time of approval (the period allocated according to the law), the Central Bank The title of the guiding institution and supervisor of the country's banking activities has provided the necessary infrastructure by creating the necessary infrastructure to become the main basis and legal framework governing the processes related to the issuance, circulation and collection of various types of checks from December this year.

* IRNA