We need to amend the banking law

Banks' capital has never grown in proportion to economic growth or inflation in the country, and only banks have been able to offset part of their capital shortage from the revaluation of their assets, which can not be very helpful. Our banking law needs to be amended and this should be pursued as soon as possible.

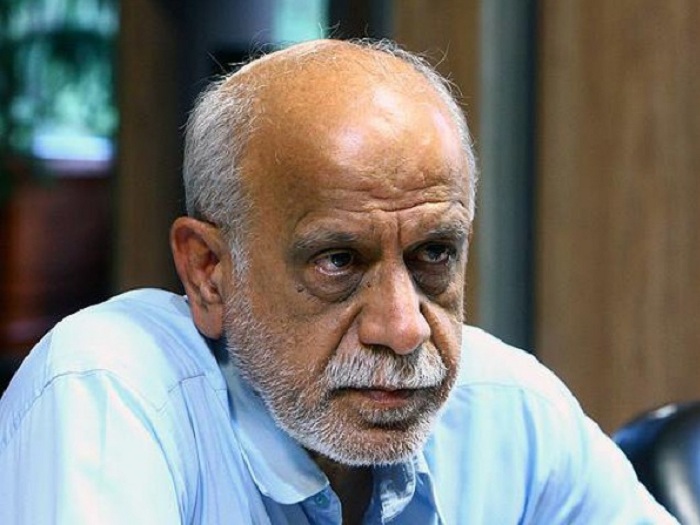

According to Iran's International Stone Exhibition, economist Ahmad Hatamiizadi has given the memo to the newspaper: Due to the financial problems that banks are facing, the resources needed for the real sector of the economy are not adequately funded and this This is where the manufacturing and industry sectors are dissatisfied with the performance of banks.

Of course, this weakness in the banking system is not only the fault of the banks, but the main problem in the economic structure and the banking sector of the country that needs to change. The central bank is currently lacking the necessary independence, and this has overshadowed central bank supervision and decision-making in the area of banking.

These conditions have caused the loans that banks are required to repay, sometimes due to inadequate justification for plans and projects that eventually lead to debt and subsequently increase banks' claims.

Banks are already facing a large amount of debt and arrears that should be returned to the banking system by the government, contractors, etc. But due to the defective economic structure, this cycle is not moving smoothly and eventually the banks have to be held accountable.

These factors, along with the issue of sanctions, have caused the banking system and the economy as a whole to suffer, and banks have failed to meet their obligations to perform their duties.

In this regard, we are in desperate need of reforming the country's banking system, and until this structure is reformed in the banks, one cannot expect banks to support the manufacturing and industry sectors as a whole. We must admit that our banks do not have enough capital to support the productive part of the country.

Banks' capital has never grown in proportion to economic growth or inflation in the country, and only banks have been able to offset part of their capital shortage from the revaluation of their assets, which can not be very helpful. Our banking law needs to be amended and this should be pursued as soon as possible.